NJ Residents: Don’t Forget To File For 2019 Anchor Benefit

Attention New Jersey Homeowners & Renters:

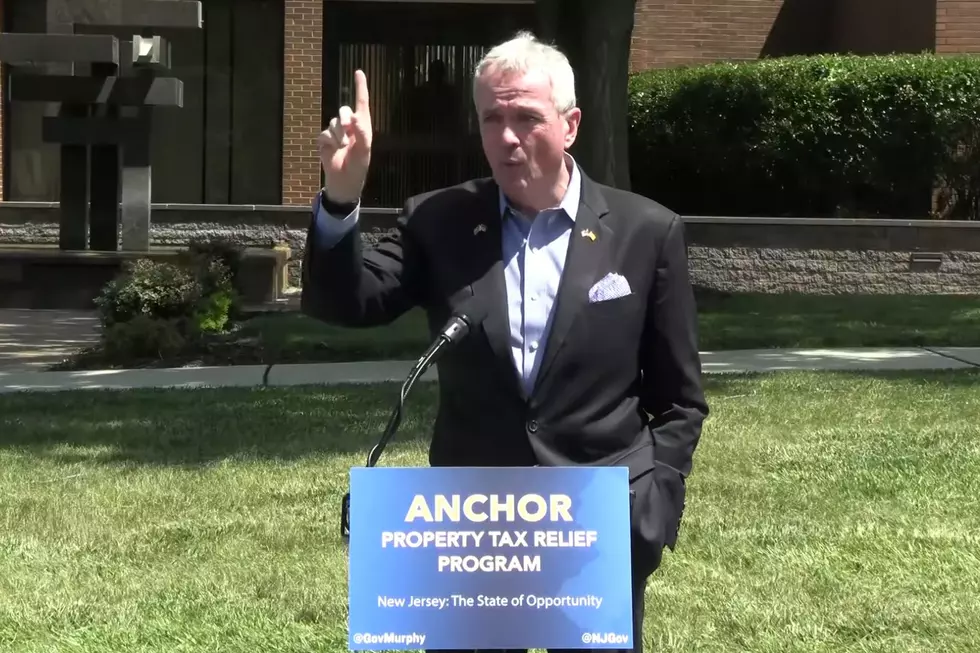

The 2019 Anchor Benefit for homeowners and renters is a property tax relief program that was announced by New Jersey Governor Phil Murphy on June 15, 2022.

We are preparing this, so that you have a one stop reminder that contains everything that you need to know about the program and how to file in order to claim your tax relief.

If your New Jersey gross income was not more than $250,000, you are eligible to receive either $1,500 or $1,000.

If you were a New Jersey renter in 2019, you are eligible to receive $450.

Most of you should have received a mailing that reads:

2019 Anchor Benefit Filing Information

You must file by December 30, 2022.

Here is the breakdown for this rebate program:

ANCHOR eligibility is as follows: "Homeowners with [an] income of $150,000 or less will receive $1,500. Homeowners with [an] income of more than $150,000 and up to $250,000 will receive $1,000. Renters with [an] income of $150,000 or less will receive $450."

You can file online, it was easy and took me about 5 minutes to complete the process.

Before going online or filing out the manual form, which you can mail-in your application to the state of New Jersey here’s the information that you’ll need to have on hand:

- Your identification number and pin number.

- Your Social Security number and if applicable your spousw/civil union partner's Social Security number.

- Birth year and if applicable your spouse/civil union partner's birth year.

- New Jersey gross income, you can find this online 29 of your year 2019 NJ – 1040 form. If you are not required to file in NJ Dash 1040 form, report zero. Do not include Social Security or railroad retirement benefits.

- Your 2019 filing status: single, married, etc.

It really is that simple. You will simply follow the instructions on the form.

You can also file by phone: toll-free 877-658-2972 in New Jersey, New York, Pennsylvania, Delaware and Maryland, or, 609-826-4288 from anywhere.

Finally, this is an important reminder, when you complete your filing you will receive a confirmation number. Make sure to save it. The confirmation number that you receive is your only proof that your application was submitted.

You can either request a direct deposit, or, the state will send you a manual check if you desire.

You have worked hard. You have earned this form of a tax rebate. However, if you don’t file for it, you’re not going to receive it.

For more information and to file online, click here.

What Are These Atlantic & Cape May, NJ Communities Best Known For?

Atlantic City Area Readers Submit Favorite Winter Comfort Foods