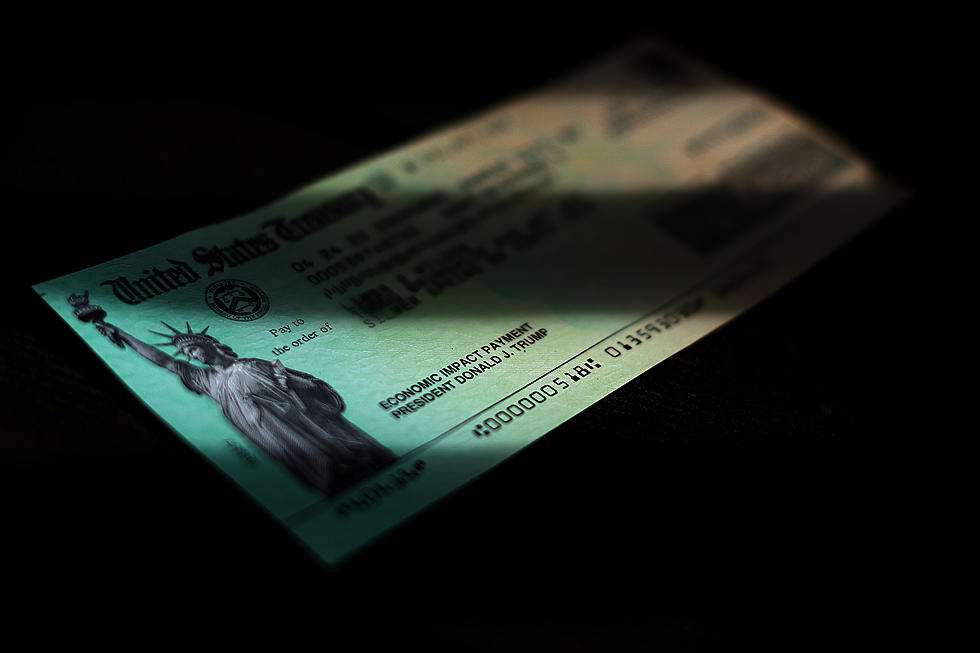

What To Do If Your Deceased Relative Gets a Stimulus Check

By now many people already used their stimulus check and that extra money is a thing of the past. Now here is the interesting part. Unfortunately in January, my girlfriend's grandmother passed away. Before her passing, she did receive the first 2 stimulus checks. Now, 3 months after my girlfriend's grandmother's passing, the family received a check addressed to her. A little weird right? We are sure they are not the only ones that have encountered such a situation.

After doing some research we found out that you must return the check to the U.S Government. The only way that someone can keep the stimulus check that is sent to a family member that is deceased is if someone in the household is on the check because they are joint filers. This would most likely be in the case if one spouse is still alive. According to the IRS, even if your name is on the check because you and your deceased family member were joint filers you may still have to return a portion of the stimulus check.

We also learned that if you are in this same situation you must write VOID on the check and mail it back to the appropriate IRS location. Here is the IRS information for New Jersey and Pennsylvania, according to Kiplinger.

- Pennsylvania - Philadelphia Refund Inquiry Unit - 2970 Market St. DP 3-L08-151 Philadelphia, PA 19104

- New Jersey - Kansas City Refund Inquiry Unit 333 W Pershing Rd. Mail Stop 6800, N-2 Kansas City, MO 64108

Don't try to be slick and cash it; the IRS does not play around.

READ ON: See the States Where People Live the Longest

More From SoJO 104.9 FM